How do I improve my credit score for a mortgage?

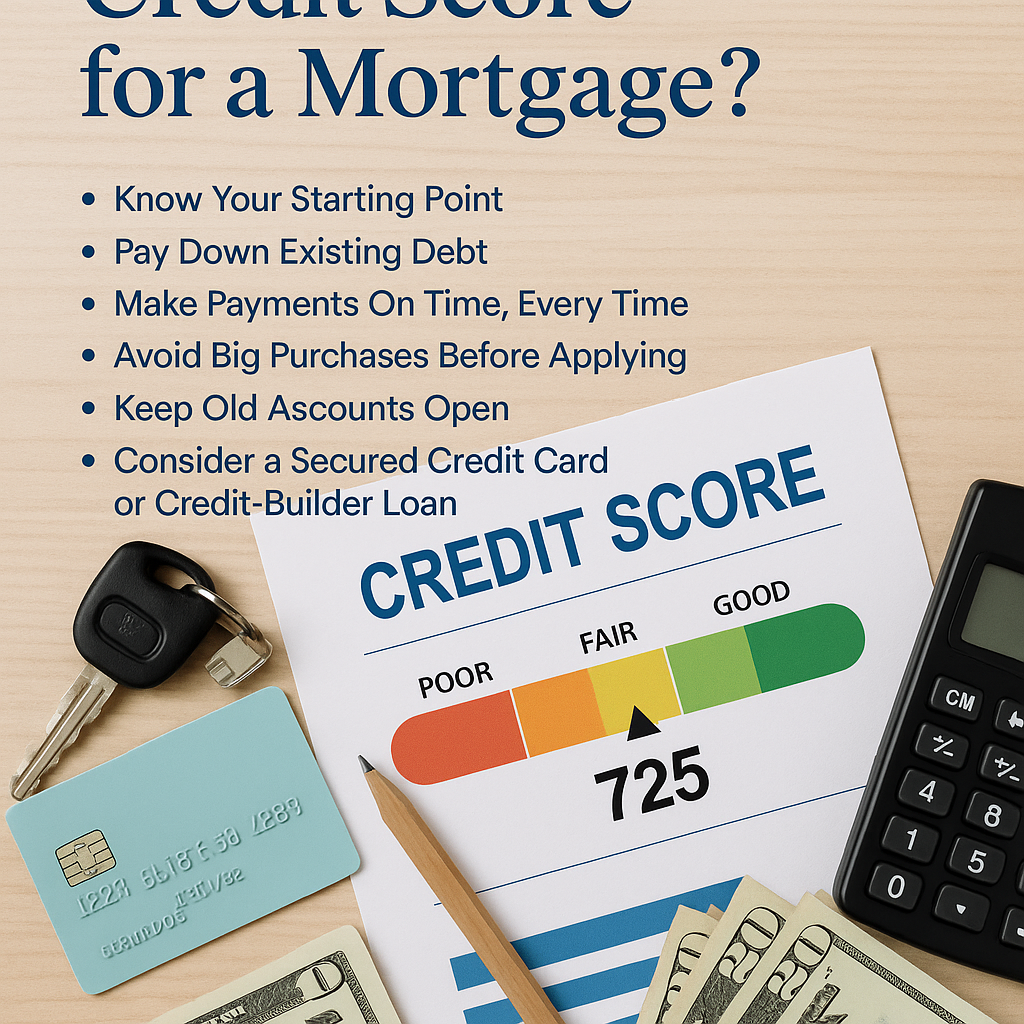

How Do I Improve My Credit Score for a Mortgage?

How Do I Improve My Credit Score for a Mortgage?

If you’re thinking about buying a home in Portland, Oregon, your credit score is one of the most important factors in securing a mortgage with favorable terms. A higher credit score can open the door to lower interest rates, better loan options, and potentially thousands of dollars saved over the life of your loan. So, how do you improve your credit score before you apply?

As Lisa Mehlhoff Homes, Portland Realtor, I work with buyers every day who are preparing to purchase their dream home. Here’s a breakdown of steps you can take to strengthen your credit and boost your buying power.

1. Know Your Starting Point

Before making changes, check your credit score and report from all three major bureaus—Experian, Equifax, and TransUnion. Look for:

-

Errors or inaccuracies

-

Old debts you’ve already paid

-

Accounts that don’t belong to you

If you find mistakes, dispute them immediately—removing errors can sometimes boost your score quickly.

2. Pay Down Existing Debt

Credit utilization (how much of your available credit you’re using) makes up about 30% of your score.

-

Aim to use less than 30% of your available credit.

-

Pay off high-interest credit cards first.

-

Avoid opening new credit lines right before applying for a mortgage.

3. Make Payments On Time, Every Time

Payment history is the single biggest factor in your credit score (about 35%).

-

Set up automatic payments or reminders to ensure you never miss a due date.

-

Even one late payment can significantly lower your score, so consistency matters.

4. Avoid Big Purchases Before Applying

That new car or expensive furniture might be tempting, but large purchases on credit can increase your utilization and lower your score. Lenders will also re-check your credit before closing—so wait until after you have the keys in hand.

5. Keep Old Accounts Open

Length of credit history impacts your score. Even if you don’t use an older account often, keeping it open can help maintain your average account age and available credit.

6. Consider a Secured Credit Card or Credit-Builder Loan

If your credit is limited or needs rebuilding, these tools can help establish a positive payment history. Just make sure they’re reported to all three credit bureaus.

Why this matters?

Improving your credit score isn’t just about getting approved for a mortgage—it’s about securing the best possible terms, which can save you tens of thousands of dollars over the life of your loan. In Portland’s competitive housing market, having a stronger credit profile can also help you move faster when the right home hits the market, giving you an edge over other buyers.

Next Steps for Portland Buyers

If you’re ready to start house hunting but aren’t sure where your credit stands, I can connect you with trusted Portland-area lenders who offer free credit reviews and guidance. The earlier you start, the more time you’ll have to make improvements before applying.

📞 Let’s talk about your homeownership goals in Portland — and put you on the path to getting the keys to your new home.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "