What are Closing Costs?

What Are the Closing Costs Associated With Buying a Home in Portland?

What Are the Closing Costs Associated With Buying a Home in Portland?

If you’re buying a home in Portland, Oregon, you’ve likely already budgeted for your down payment. But there’s another key piece of the puzzle that catches many buyers off guard—closing costs. These fees can add up to thousands of dollars, and knowing what to expect (and why they matter) can help you walk into closing with confidence instead of surprises.

What Are Closing Costs?

Closing costs are the final fees and expenses you’ll pay when you close on your new home. They cover everything from lender charges to title insurance, and they vary based on your purchase price, loan type, and even the neighborhood you buy in. In Portland, buyers can generally expect closing costs to be 2% to 5% of the home’s purchase price.

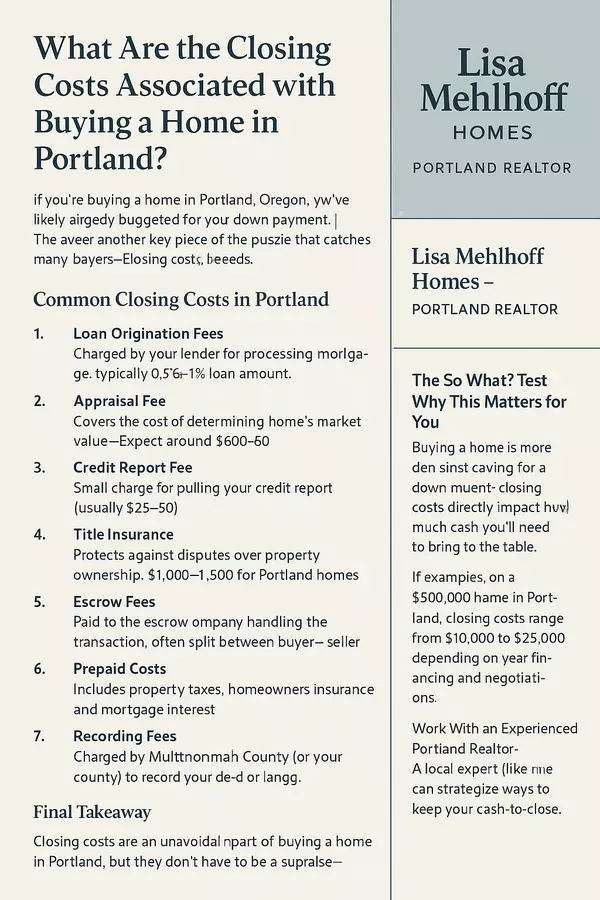

Common Closing Costs in Portland

Here’s a breakdown of the most common costs for Portland homebuyers:

1. Loan Origination Fees

-

Charged by your lender for processing your mortgage.

-

Typically 0.5%–1% of the loan amount.

2. Appraisal Fee

-

Covers the cost of determining your home’s market value.

-

Expect around $600–$800 in Portland.

3. Credit Report Fee

-

Small charge for pulling your credit report (usually $25–$50).

4. Title Insurance

-

Protects against disputes over property ownership.

-

Varies, but often $1,000–$1,500 for Portland homes.

5. Escrow Fees

-

Paid to the escrow company handling the transaction.

-

In Portland, often split between buyer and seller.

6. Prepaid Costs

-

Includes prepaid property taxes, homeowners insurance, and mortgage interest.

7. Recording Fees

-

Charged by Multnomah County (or your county) to record your deed and mortgage.

Why This Matters for You?

Buying a home is more than just saving for a down payment—closing costs directly impact how much cash you’ll need to bring to the table. Without planning, they can delay your purchase or limit the homes you can afford.

For example, on a $500,000 home in Portland, closing costs could range from $10,000 to $25,000 depending on your financing and negotiations. Knowing this ahead of time means you can:

-

Adjust your budget to avoid financial strain.

-

Negotiate with the seller for credits to offset these costs.

-

Time your purchase to align with your savings.

How to Reduce Your Closing Costs

-

Negotiate Seller Credits – In a balanced or buyer-friendly market, sellers may offer credits toward your closing costs.

-

Shop Your Lender – Different lenders have different fee structures.

-

Ask About Lender Incentives – Sometimes lenders will cover certain fees during special promotions.

-

Work With an Experienced Portland Realtor – A local expert (like me!) can strategize ways to keep your cash-to-close as low as possible.

Final Takeaway

Closing costs are an unavoidable part of buying a home in Portland, but they don’t have to be a surprise—or a roadblock. With the right planning and guidance, you can prepare for them, reduce them, and move forward with confidence.

If you’re thinking about buying a home in Portland and want a clear picture of your total costs from day one, let’s talk.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "