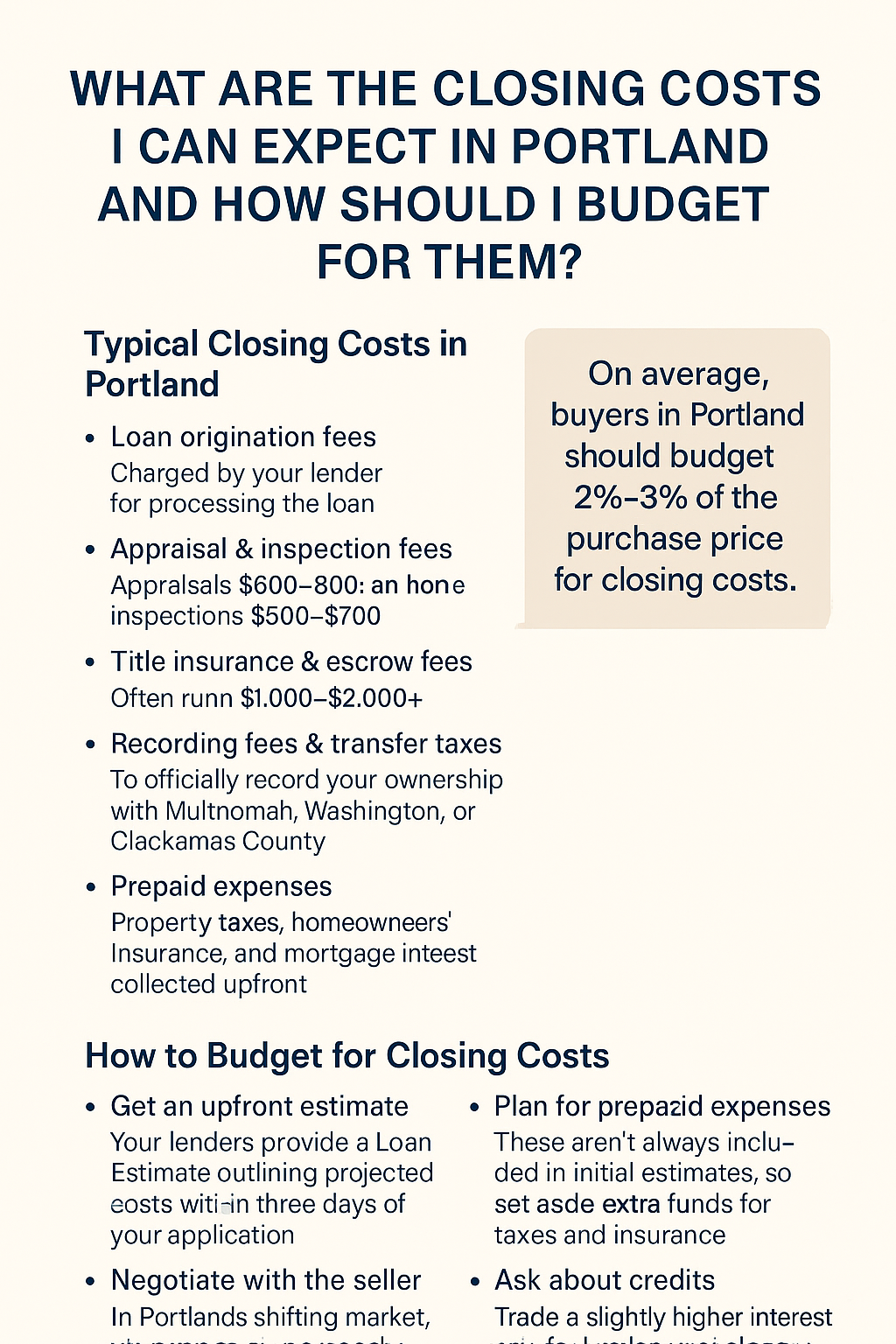

What Are the Closing Costs I Can Expect in Portland and How Should I Budget for Them?

What Are the Closing Costs I Can Expect in Portland and How Should I Budget for Them?

Buying a home in Portland is exciting, but many first-time and even repeat buyers are caught off guard by the final step: closing costs. These are the fees and expenses you pay at the end of a real estate transaction to finalize your purchase. Understanding what they include—and how to budget for them—can help you avoid surprises and keep your homebuying journey on track.

Typical Closing Costs in Portland

While exact numbers vary depending on the price of the home, type of loan, and negotiations, here are the common closing costs you can expect:

-

Loan origination fees – Charged by your lender for processing the loan (usually 0.5–1% of the loan amount).

-

Appraisal & inspection fees – Appraisals typically cost $600–$800 in Portland; home inspections run about $500–$700.

-

Title insurance & escrow fees – Title insurance protects your ownership; escrow handles funds. Combined, they often run $1,000–$2,000+.

-

Recording fees & transfer taxes – To officially record your ownership with Multnomah, Washington, or Clackamas County.

-

Prepaid expenses – Property taxes, homeowners’ insurance, and mortgage interest collected upfront.

On average, buyers in Portland should budget 2%–3% of the purchase price for closing costs. For example, on a $600,000 home, this could be $12,000–$18,000.

How to Budget for Closing Costs

-

Get an upfront estimate – Your lender must provide a Loan Estimate outlining projected costs within three days of your application.

-

Negotiate with the seller – In Portland’s shifting market, it’s common to request the seller cover part of your closing costs.

-

Plan for prepaid expenses – These aren’t always included in initial estimates, so set aside extra funds for taxes and insurance.

-

Ask about credits – Sometimes, you can trade a slightly higher interest rate for lender-paid closing costs.

So What? Why This Matters to You

Closing costs aren’t just small details—they directly impact how much cash you need to bring to the table and whether you can comfortably move forward. Buyers who plan ahead can avoid last-minute stress, negotiate stronger offers, and make informed financial decisions.

As a Portland Realtor, I walk my clients through these numbers early so they’re never blindsided. If you’re thinking of buying in 2025, let’s sit down and run the math together—your future self will thank you.

—

Lisa Mehlhoff Homes | Portland Realtor | Helping buyers and sellers move with clarity, care, and confidence.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "